Chime claims you’ll get paid up to 2 days earlier when using Chime direct deposit.

Is that true and how does Chime direct deposit even work?

What Time Does Chime Direct Deposit Hit?

Direct deposits with Chime will be in your Chime account up to 2 days before your payday. At the latest, you will receive your direct deposit at 9:00 AM EST on your payday. This, however, is rather unusual, usually, you will receive your direct deposit with Chime 1-2 days before your payday.

How long it will actually take for the direct deposit to hit your account largely depends on how fast your employer or benefits provider and their bank process things.

Employers usually submit their payroll 5 workdays before payday to their bank. In that case, you should receive your Chime direct deposit 2 days before your payday because Chime doesn’t hold direct deposits for 2 days like traditional banks do.

If you haven’t received your Chime direct deposit 2 days early your employer or your employer's bank has likely processed things too slowly.

Here’s when you should expect direct deposit in your Chime account at the latest:

- Monday: By 9:00 AM EST

- Tuesday: By 9:00 AM EST

- Wednesday: By 9:00 AM EST

- Thursday: By 9:00 AM EST

- Friday: By 9:00 AM EST

- Weekends & Federal Holidays: No direct deposits processed

- Day After Holidays: By 9:00 AM EST

Does Chime Direct Deposit Hit at Midnight?

No, Chime will deposit your money into your Chime account right after they receive the deposit.

This means that the deposit could hit your account at any time between midnight and 9:00 AM EST.

Does Chime Direct Deposit on Weekends/Federal Holidays?

No, Chime only direct deposits Monday through Friday and not on the weekend or on federal holidays.

If your direct deposit was scheduled to hit your bank account on Saturday or Sunday, or on a federal holiday, it will usually hit your Chime account on the following business day.

Here are all federal/bank holidays observed by Chime:

- January 1: New Year’s Day

- January 17: Birthday of Martin Luther King, Jr. (MLK Day)

- February 21: Washington’s Birthday (President's Day)

- May 30: Memorial Day

- July 4: Independence Day

- September 5: Labor Day

- October 10: Indigenous Peoples' Day

- November 11: Veterans Day

- November 24: Thanksgiving Day

- December 25: Christmas Day

How Do I Know the Status of My Chime Direct Deposit?

Chime doesn’t hold any direct deposits, meaning that once Chime receives the funds they will go straight into your account. That’s why Chime can’t give you any information about the status of your direct deposit, simply because they don’t have any information.

You can enable push notifications and email notifications for when the direct deposit hits your account so you will know as soon as it hits your account.

To enable these notifications you need to go to Settings on Chime and then enable transactions notifications.

If you haven’t received your Chime direct deposit until one day after your payday you should contact your employer or benefits provider and ask them about the status of your pay.

Does the First Chime Direct Deposit Come Late?

Yes, usually your first Chime direct deposit doesn’t come 2 days early.

This has nothing to do with Chime but it often takes your employer/benefit provider some extra time to set up the initial direct deposit. However, once the payment is on its way to Chime it shouldn’t take any longer than your second or third direct deposit.

Is Chime Direct Deposit Free?

Yes, Chime doesn’t charge any fees for direct deposits. You also don’t have to worry about any hidden fees, it’s 100% free.

How Does Chime Direct Deposit Work?

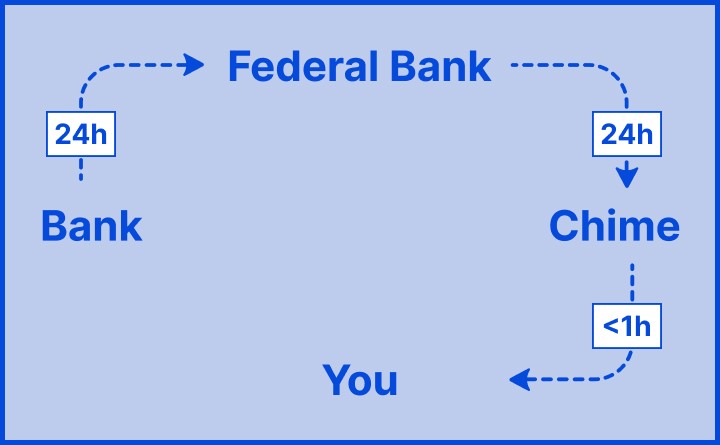

To understand how Chime direct deposit works you first have to understand how modern banking works.

Below I have put together a simplified example of how Chime and the modern banking system work:

Let’s say your employer sends the payment information to it’s company bank on Monday, the set payday is Friday.

The company’s bank will process the information on Monday and send the processed information to the federal bank on Tuesday.

The federal bank will process the information on Tuesday and send the information to Chime on Wednesday.

Chime will deposit the money to your account almost instantly once it receives the information from the federal bank.

It is important to understand here that Chime hasn’t received the money yet. The money is still at the bank of your employer until the set payday, which is Friday. Chime uses its own money to fund your account.

Traditional banks don’t do that, they wait until the payday to fund your account because they only get the money then.

That’s why you get paid up to 2 days early with Chime direct deposit.

How to Setup Early Direct Deposits With Chime:

To setup direct deposits with Chime, you need to have your Account Number and your Routing Number.

Those two numbers can be found under Settings, and then Account Information on Chime.

You have two options to setup direct deposits either manually via the direct deposit form or automatic via the employer portal.

Setup Direct Deposit Manually via Direct Deposit Form:

- On your Chime app go to Settings > Account Information > Set Up Direct Deposit > Get Direct Deposit Form

- Click on Get Direct Deposit Form

- You should receive the Direct Deposit Form by email

- Fill out the Direct Deposit Form, in the Amount section you have to choose one of three options: Deposit my entire paycheck, Deposit $__ dollars of my paycheck, Deposit __% of my paycheck

- Under Authorization write the name of your employer/benefit provider

- Submit the form to your employer/benefit provider

Setup Direct Deposit Automatically via Employer Portal:

- Log directly into your payroll provider/government portal

- Go to Update Payment Method

- Fill out the form

- Choose the amount you wish to deposit

- Save